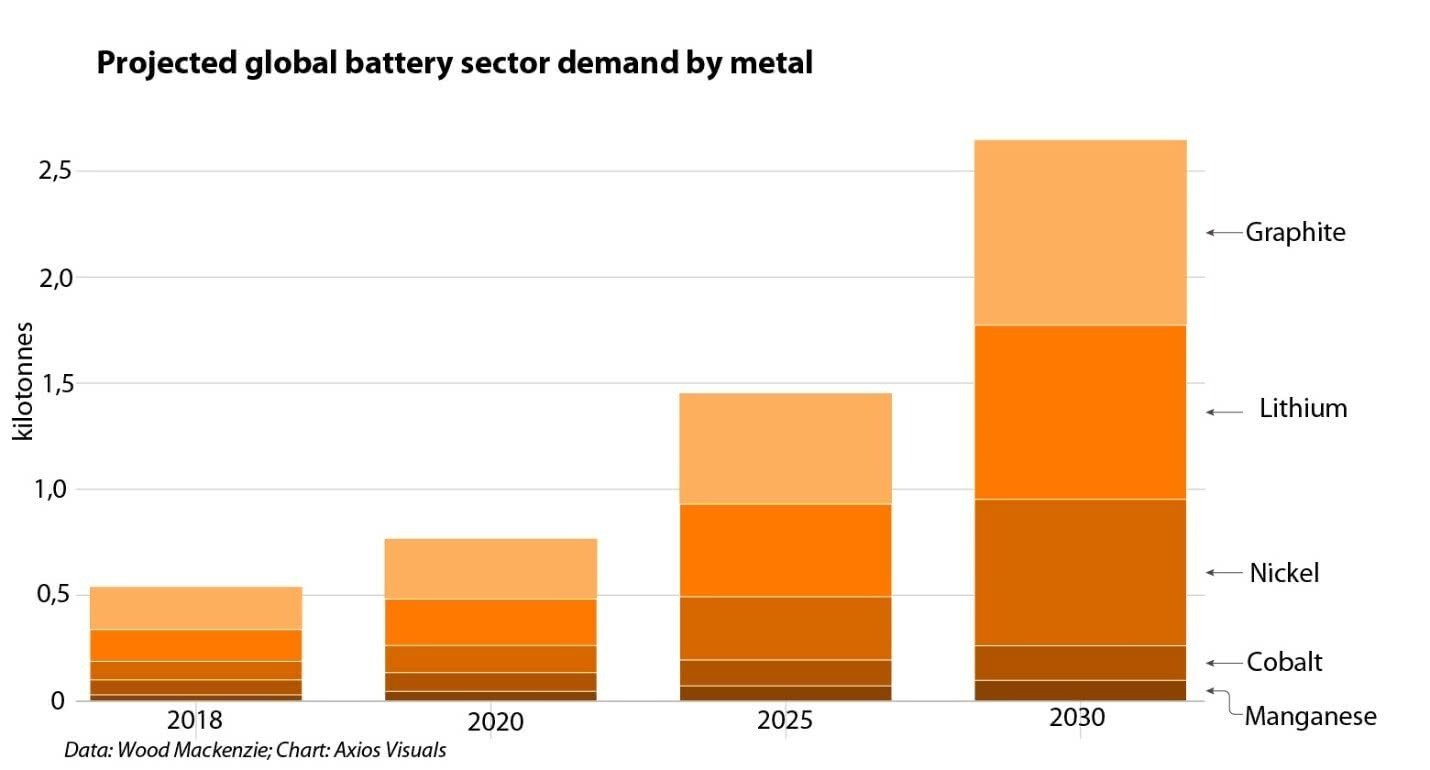

Consulting agency Wood Mackenzie said on Wednesday that by the mid-2020s there could be a “supply shortage” of cobalt, lithium and nickel used in batteries for electric vehicles and other applications.

Wood Mackenzie predicts that 7% of all sales of passenger cars in 2025 will be accounted for all-electric cars and hybrids, 14% – by 2030 and 38% by 2040. It is noteworthy that this forecast is less optimistic than BloombergNEF, which believes that the share of electric vehicles will account for 57% of sales of passenger cars in 2040.

The electrification of transport redefines the markets of a number of metals. According to Wood Mackenzie, supply chains of raw materials for batteries can be one of the reasons for the slow introduction of electric vehicles. Most car manufacturers plan to fully switch to electric vehicles by 2050. However, if battery technology is not improved, tested, commercialized, and integrated into electric cars and their supply chains as quickly as possible, it will be impossible to achieve targets for the introduction of electric vehicles, as well as to ban vehicles with internal combustion engines.

Wood Mackenzie predicts an increase in raw material demand for batteries over the next decade, expressed in two-digit numbers. In this case, the main driving force will be the demand for electric cars.

Demand for lithium will be high, but the capacity for its extraction and processing will also grow in the long term. However, the picture of supply of nickel and cobalt is much more complicated.

According to the Wood Mackenzie base scenario, the demand for cobalt will double by 2025, although it is likely that the cobalt market will collapse in the next few years. The unique characteristics of cobalt mean that its mining itself is uneconomical, and it is mined mainly as a by-product of other metals — primarily copper and nickel. As the cobalt market becomes tougher in the long term, the inability of the mined cobalt to respond to growing demand will become a huge problem. Dependence on supplies from the Democratic Republic of the Congo (DRC) will only increase in the coming years, since all the largest cobalt-containing projects are located there. But geopolitical risks in the DRC are only growing.

Long-term nickel prospects have already raised concern for current enthusiasts for electric cars. The nickel market for several years was in conditions of low prices and insufficient investments. New demand from electric vehicles and energy storage creates a widening supply gap by the 2020s, and there seems to be little appetite for new investments in nickel projects.

What should happen so that the supply of raw materials does not stop the electromobile revolution?

The key decision is the growth of investments: new mines should be put into operation; and technologies of batteries with different chemical composition should be developed. Although the work on increasing the energy density of batteries continues, changes in the industry take time, and it is difficult to predict how much. Disposal and recycling of batteries will be crucial to reduce the shortage of these metals, although this will still not be enough.

One thing is certain: the raw materials sector for batteries will continue to evolve, and the pace of its change will dictate the speed of introduction of electric vehicles into our lives.